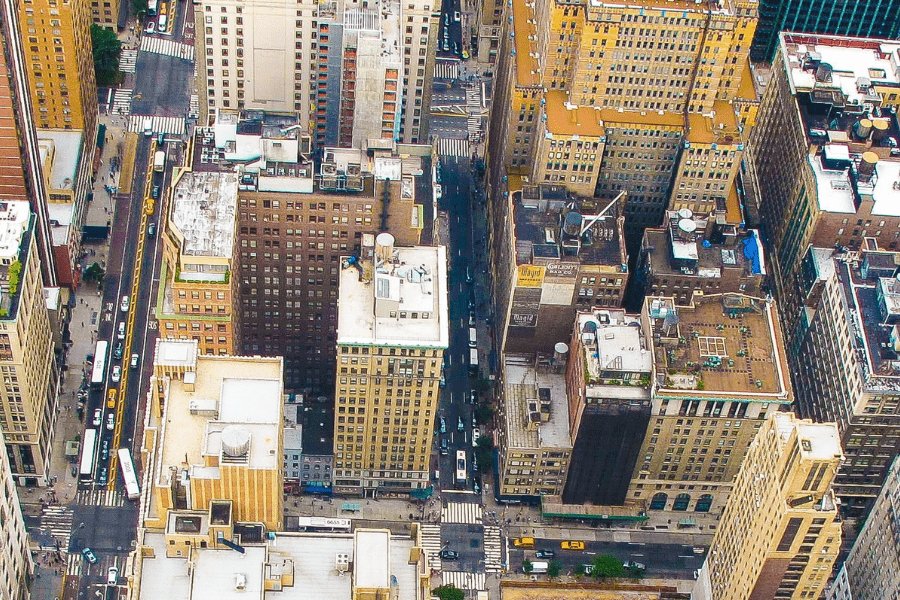

In New York City today, there’s a growing movement of owners looking to sell large, prewar multifamily assets. These owners have typically owned the building for over 30+ years and are hoping to take the next step in their personal or investment lives. Recent rent legislation has only increased this desire.

NYM GroupJune 25, 2019